Embedded Design

Teams HumanisingFintech

An 8-year partnership journey transforming how millions experience financial services, wealth planning and investment.

Partnership Background

In an industry built on trust and expertise, the challenge extends beyond digital transformation to true democratisation. YUJ’s partnership with a Fortune 50 financial services leader tackled this by embedding design teams within the organisation. What began as a platform redesign evolved into a user-centred transformation-making sophisticated financial tools accessible to first-time investors, supporting multi-generational needs, and achieving accessibility while reducing cognitive load and reinforcing trust.

The YUJ Edge

01

Embedded design teams integrated with product and compliance

02

User studies spanning age groups, financial literacies, and life stages to bridge generational investor needs

03

Accessibility-first approach ensuring inclusive financial access

04

Iterative design reducing cognitive load in complex financial decisions

The Partnership Journey

Foundation Building

2019–2020 marked initial integration of design and client core teams for seamless collaboration.

Investment Platform Launch

In 2021, focus was on creating a distraction - free platform tailored for first-time investors.

Innovative Wealth Tools

2022 introduced multi-generational wealth planning tools with advanced mapping and visualizations.

Accessibility Excellence

Achieved platform-wide WCAG compliance in 2023, ensuring inclusive user experiences.

Cross-collaboration Optimization

2025 partnership optimized product experiences and reduced cognitive load across teams.

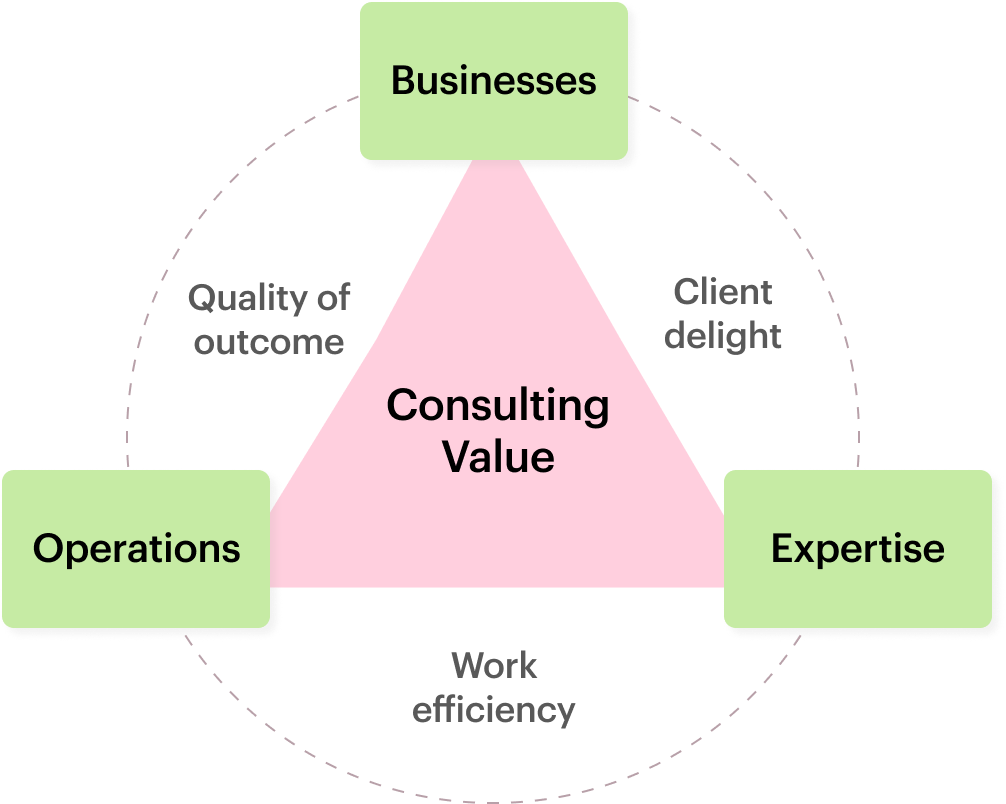

Design That Transforms Business Outcomes

In financial services, design isn't just about interfaces - it’s about building trust, reducing anxiety, and empowering confident decisions across digital wealth journeys. We integrated business vision, behavioural finance principles, and regulatory expertise to create experiences that transform how people engage with their financial future on a digital wealth management platform.

- Understanding wealth management business models and competitive positioning

- Research into investor psychology across generational cohorts

- Navigating regulatory constraints while innovating user experiences

- Mapping financial decision journeys from first investment to estate planning

- Designing for trust, transparency, and confidence in high-stakes decisions

- Balancing sophistication for experts with simplicity for first-time users

Impact by Design

42%

Decrease in time for first investment

12,500+

Families adopted multi-generational planning tools within first six months

15%

Increase in users over 65 engaging with digital planning tools

28%

Increase in average account lifetime as families consolidated assets onto single platform

89%

Users rated the Family Wealth Canvas as "extremely helpful" for planning conversations

100%

WCAG 2.1 AA compliance- first major wealth platform to do so

41%

Reduction in customer service calls related to navigation issues

67%

Platform Net Promoter Score increased from 42 to 67

24%