Banking application

Improving Loan Application Experience through UX Design

In A Nutshell

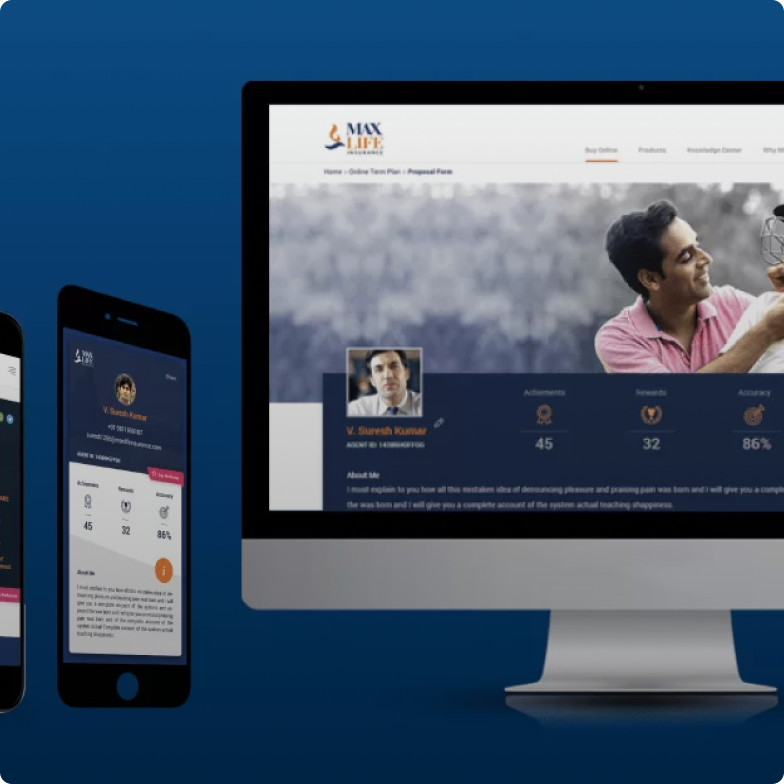

Banking application Creditflow is a white-label application that enables bank sales executives to visit customer locations and assists in creating digital requests for bank products. The primary goal was to design and develop a mobile application of banking products that positioned the company at a broad level and increased customer adoption.

Defining the Problem

Banking application caters to banks providing financial products. These banks need a brand customisable application that can help their agents connect and keep track of potential customers assisting them efficiently fill mandatory long forms.

YUJ Designs understood the current ecosystem with regard to the scenarios in which all the user tasks are carried out.

The problems found were:

- Agents often struggled with even the basic tasks, e.g. users were not able to save or pause the form and get back to it at a later time. Instead, they had to fill it again from scratch.

- Creating loan application was quite time-consuming and users could not get real time data on applications.

Solution

We crafted aesthetically pleasant application design for global languages making sure that all status updates and tasks are conveniently accessible. We developed the app by adding feature to pause in the middle of the form filling process and complete it later. Our development team ensured optimal experience and time by reducing the form filling time by providing data collection options like local ID scanning to auto-populate form fields.

In the absence of internet connectivity, the mobile app provides the facility to fill customer’s form offline and then upload it later. This application empowers bankers by increasing their efficiency using region specific automated data collection. In short, we designed and developed a mobile app that facilitated strong communication, flexibility, agility, transparency and real time data capture.

Business Benefits

- The design of the mobile app is user centric and intuitive, which led to elimination of training requirements for employees.

- It facilitates location tracking of agents (enhacing efficiency) as well as online and offline data capturing customer.

- It saved time helping banking professionals create loan application in few minutes and obtain real time data on it, which led to increase in customer adoption thereby boosting their business.

Increased

customer base

Increased

banker’s efficiency

Enables

tracking of agents

Reduces training

requirements

Enables capturing

online & offline data

Creates application

in short time