Revolutionising financial crime detection

Empowering financial institutions through unified fraud and AML investigation workflows

In a nutshell

In a nutshell

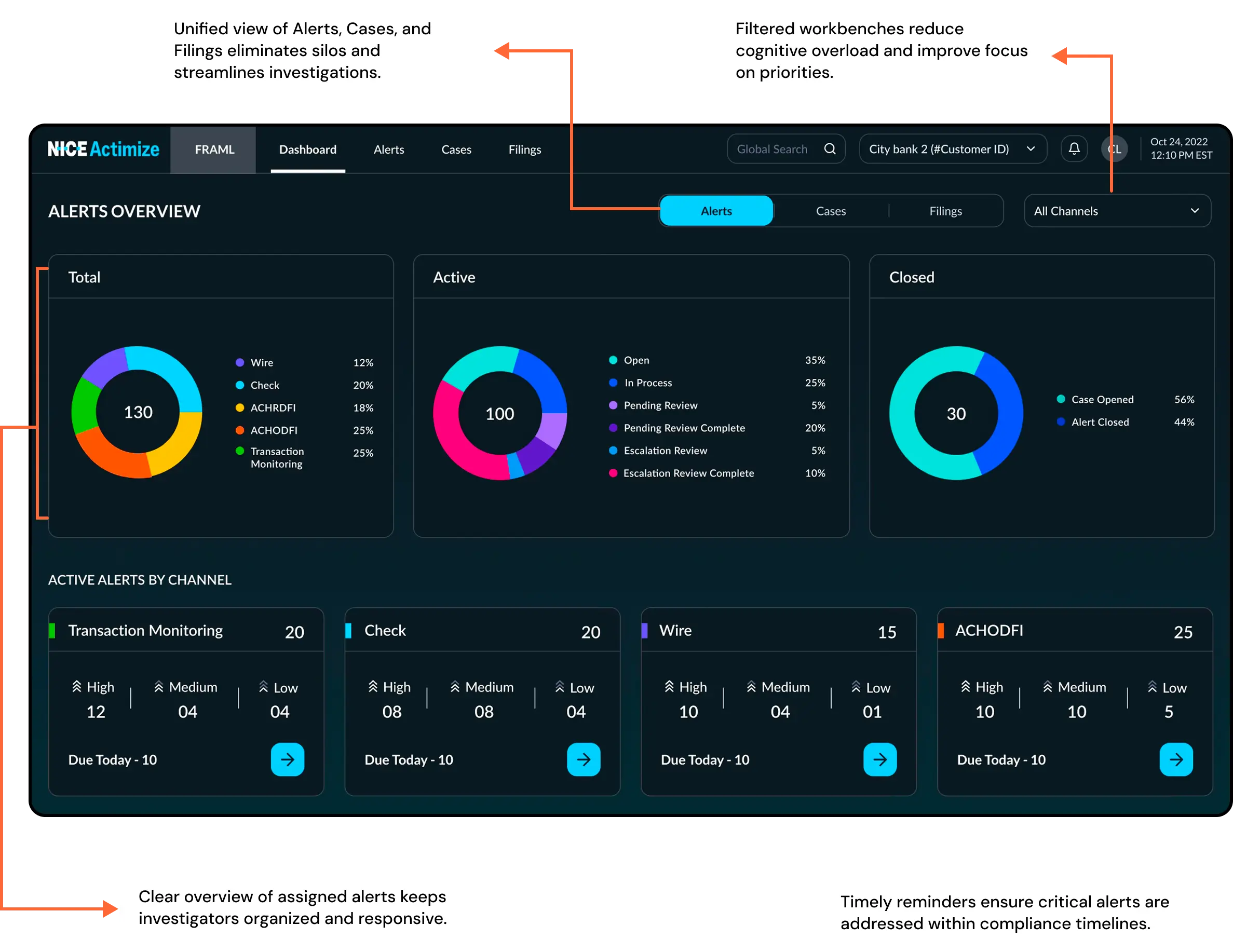

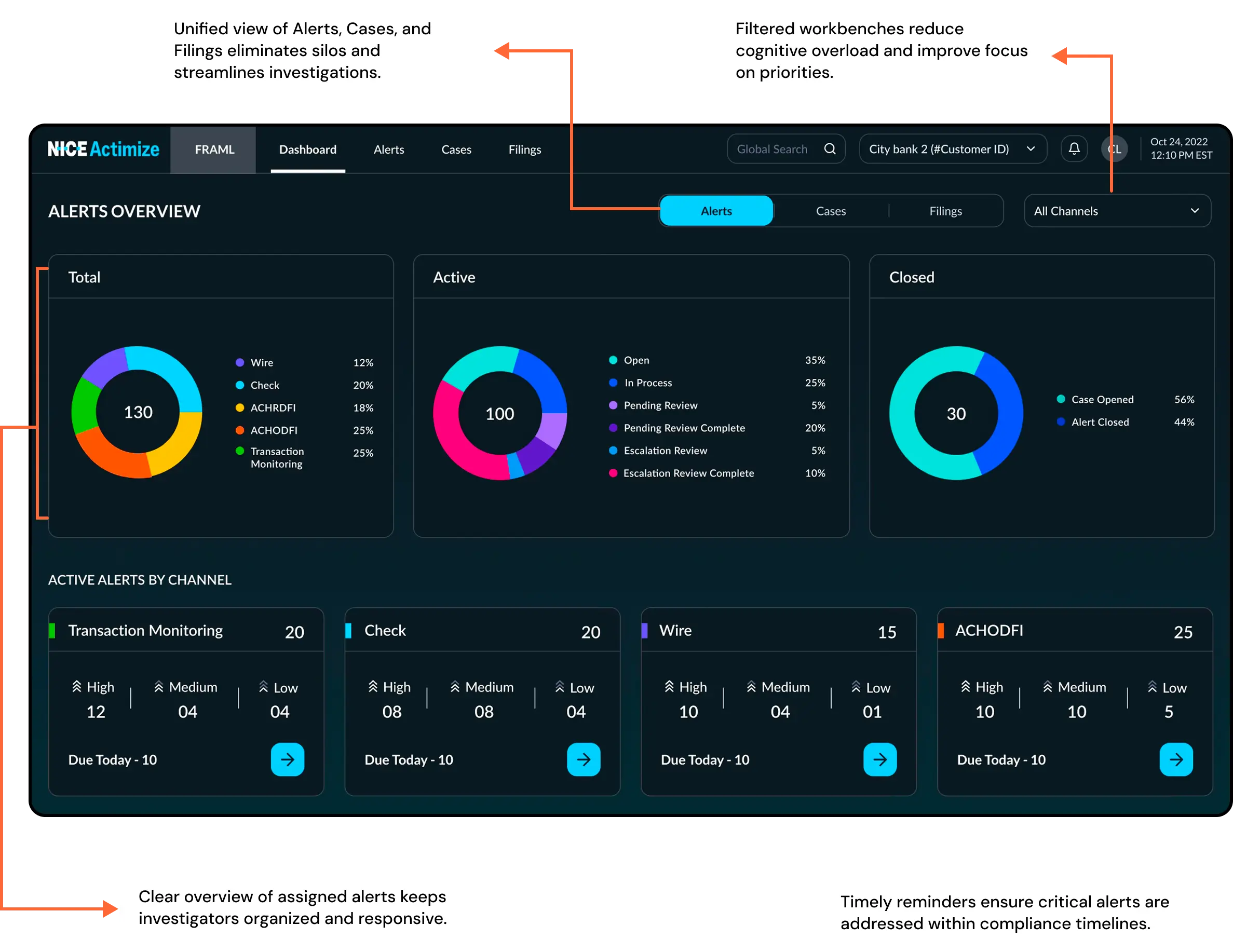

Financial institutions face fragmented systems that hinder fraud and AML investigations. Our partnership with NICE provides a unified AI-driven platform to detect, prevent, investigate, and report financial crimes. By consolidating alerts into a single intuitive workbench, it cuts investigation time, improves accuracy, and ensures compliance.

Business goals

Our design workshop with the global leadership team gathered combined vision and stakeholder immersion to understand core objectives

Unified Platform

- Integrate fraud and AML into a single cohesive experience

- Enable institutions to tackle complex crimes while meeting evolving regulations

Increase Consulting Revenue

- Boost productivity of internal consulting teams to deliver greater value

- Help customers stay compliant while driving revenue growth

Cross Functional

- Empower Fraud & AML teams to share critical behavioral data

- Accelerate detection, prevention & reporting of financial crimes

- Gain industry edge through strong regulatory compliance

Flexible & Scalable

- Adapt and scale for institutions of all sizes

- Offer curated portfolios aligned with processes and SLAs

- Drive portfolio expansion and new business growth

Challenges

Fragmented Systems

Multiple disconnected platforms create information silos, forcing specialists to waste time switching between systems while critical patterns get lost in complexity.

Cognitive Overload

Scattered information across interfaces overwhelms investigators, making it difficult to prioritize high-risk cases and requiring time-consuming manual data correlation.

Regulatory Pressure

Strict compliance deadlines and complex reporting requirements demand comprehensive audit trails to satisfy regulatory examination standards.

Scalability Constraints

Growing transaction volumes and evolving criminal tactics strain investigation teams already facing resource limitations and operational capacity challenges.

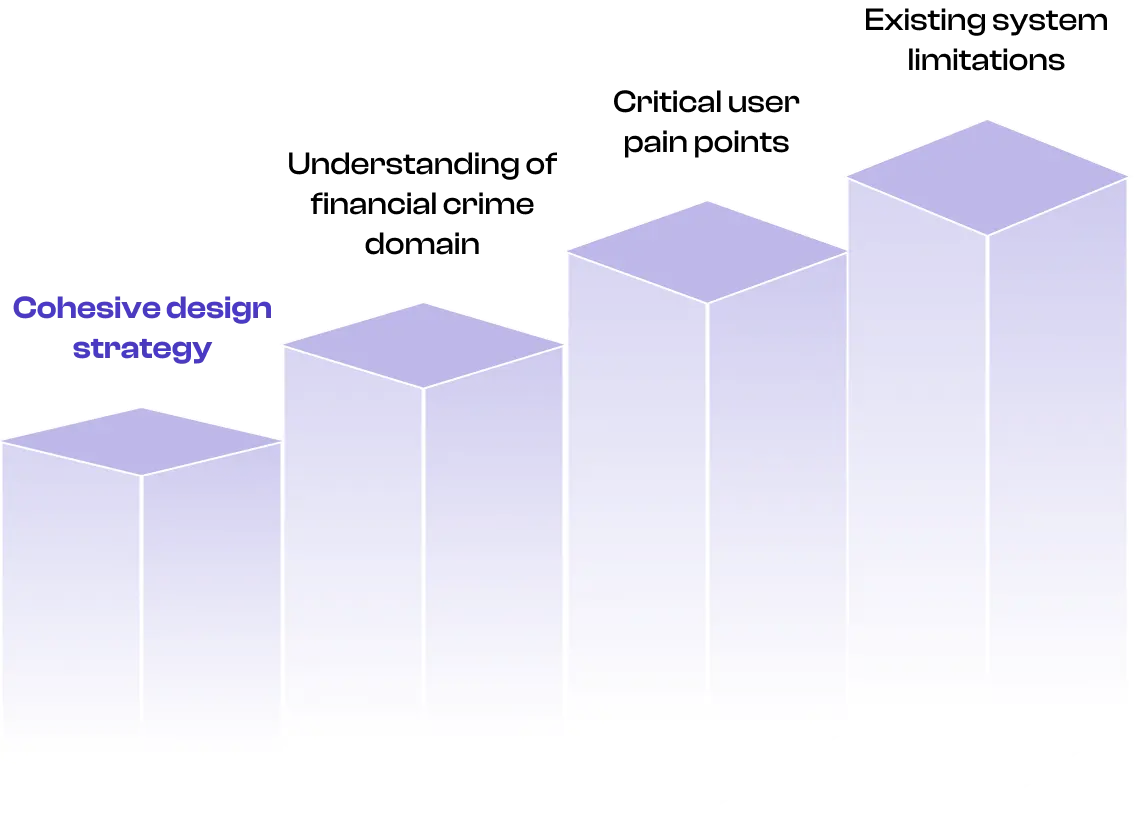

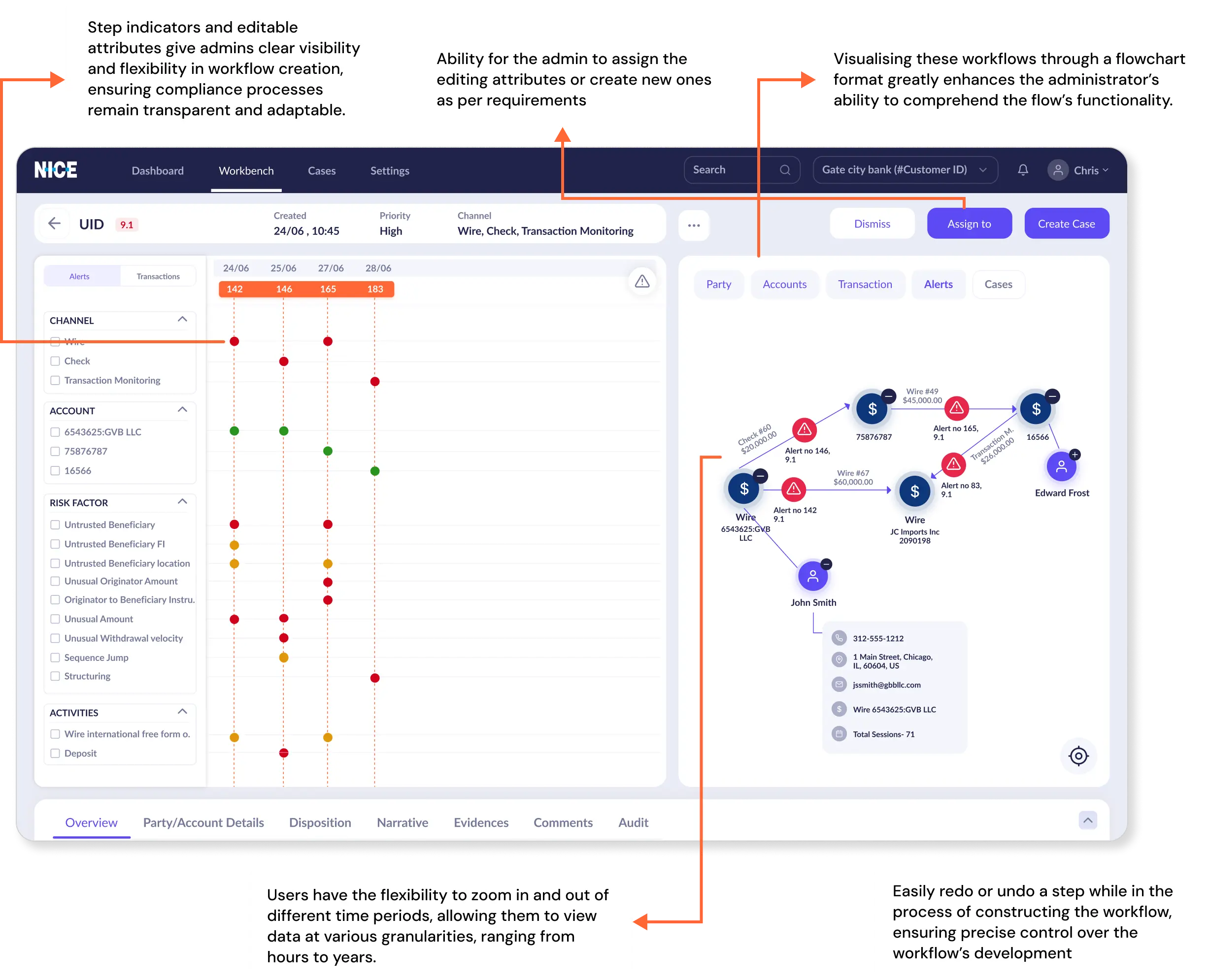

Creating the roadmap

- We turned complex regulations and fragmented workflows into a cohesive design strategy, building deep insights into the financial crime domain, system gaps, and key user pain points.

- We mapped specialist personas, analyzed their daily challenges, and studied the impact of cognitive overload on efficiency—insights that shaped our strategic design approach.

User personas

I need global search capabilities across the platform, automation for repetitive tasks, and auto-allocation of alerts to analysts to manage complex cases efficiently.

I need critical details of open cases upfront to make decisions faster, with dashboards showing all critical data points and relevant alert history in one place.

I need clear visual guidance and streamlined workflows to efficiently process cases while building my expertise in financial crime detection.

I need auto-allocation of alerts to analysts and a comprehensive dashboard snapshot that guides me to focus on alerts requiring immediate attention.

Design approach

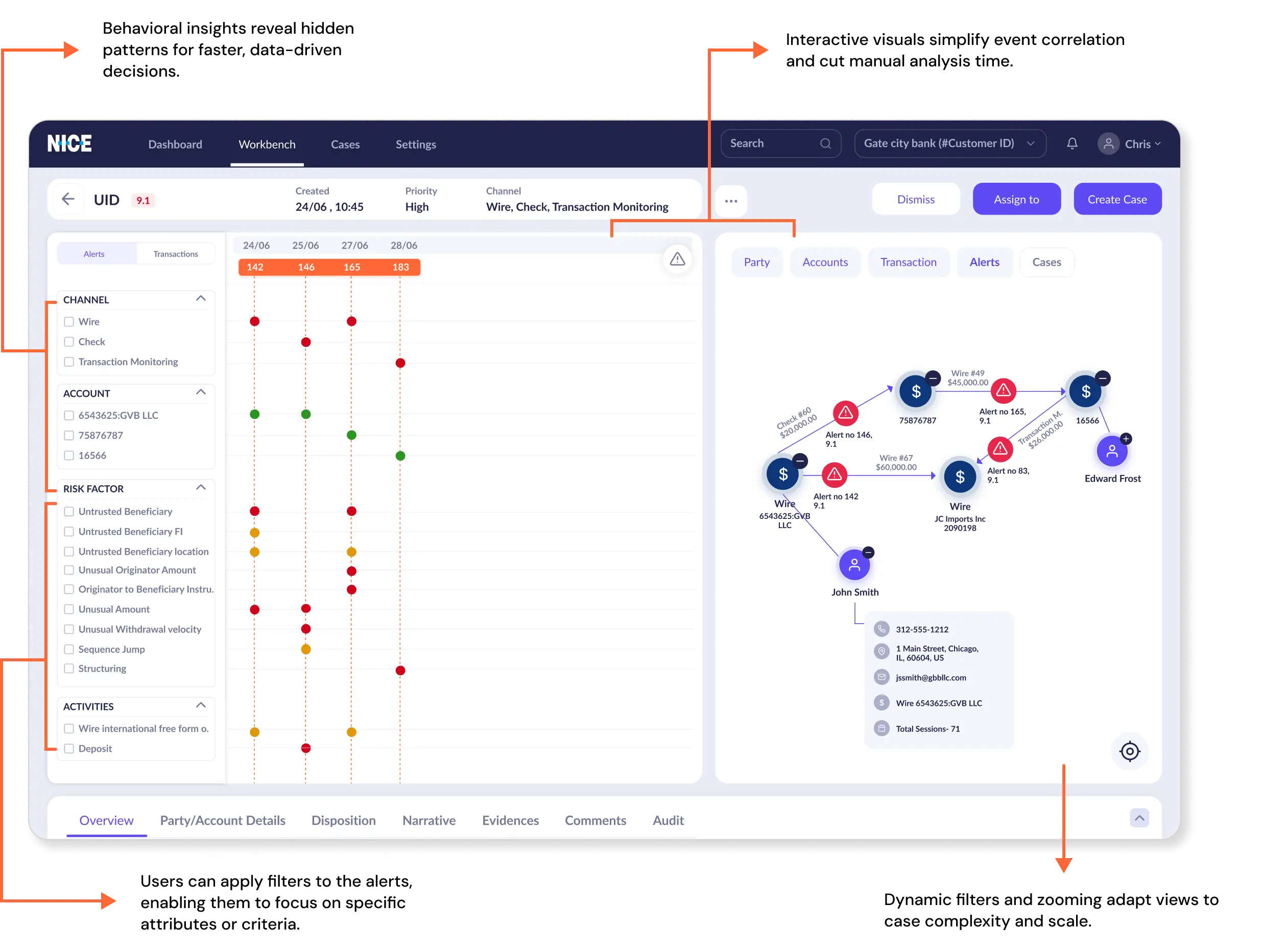

Cognitive load reduction

Transform overwhelming data streams into digestible, prioritized insights for focused decision-making

Workflow unification

Create seamless transitions between fraud and AML investigations with consistent interactions

Adaptive intelligence

Build responsive interfaces accommodating both seasoned investigators and new analysts effectively

Real-time aggregation

Enable instant access to consolidated behavioral patterns and risk indicators across platforms

Compliance integration

Embed regulatory requirements seamlessly into workflows without disrupting investigation efficiency

The outcome

Impact by design

Reduced Investigation Time

40% reduction in average case resolution time as specialists leveraged aggregated data and behavioral insights for faster decision-making.

Enhanced Decision Accuracy

25% improvement in true positive detection rates as investigators identified suspicious patterns more accurately through the unified platform.

Improved Regulatory Compliance

99.2% compliance rate achieved by financial institutions through automated reporting and comprehensive audit trails.

Increased Operational Efficiency

30% increase in team productivity driven by streamlined workflows and intelligent workload management, without compromising investigation quality.

Better Risk Management

35% reduction in potential financial losses enabled by real-time aggregated alerts that support proactive risk identification.